Over the past few years, Operational Value Creation has emerged as the primary engine of Private Equity (PE) returns, surpassing the traditional reliance on financial engineering. While leverage and financial structuring dominated in the 1980s, today’s value creation is increasingly driven by improving the actual performance of portfolio companies. This marks a fundamental shift in PE strategy: firms are now focused on building stronger, more competitive businesses, not just clever financing.

Over the past few years, Operational Value Creation has emerged as the primary engine of Private Equity (PE) returns, surpassing the traditional reliance on financial engineering. While leverage and financial structuring dominated in the 1980s, today’s value creation is increasingly driven by improving the actual performance of portfolio companies. This marks a fundamental shift in PE strategy: firms are now focused on building stronger, more competitive businesses, not just clever financing.

Author: Mark Winsbury

Rethinking Returns: How Operational Value Creation Took Centre Stage

High purchase prices and rising interest rates have made it harder to rely on simple financial tricks. In the past, PE firms could buy companies at low valuations, add cheap debt, cut a few costs, and resell for a quick profit. Those days are fading. With interest rates up and asset valuations still high, pure financial engineering is no longer sufficient as a strategy to achieve appropriate returns. Instead, deep operational commitment and industry expertise are required to boost a company’s performance during the hold period.

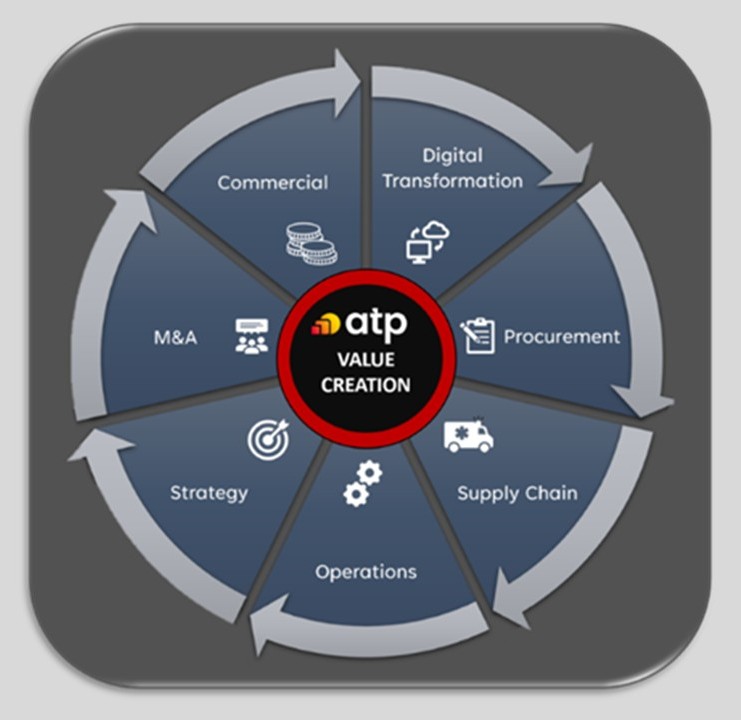

According to data from Preqin Ltd, 70% of institutional investors now expect a clear Operational Value Creation Plan even before a deal is finalised. In this evolving landscape, specialised firms like ATP; which go beyond traditional advisory roles to actively implement plans, are playing an increasingly critical role. As a result, private equity is becoming more execution-focused, value-driven, and ultimately more successful.

From Financial Engineering to Operational Focus

Several market forces have pushed PE in this direction.

1.Higher entry multiples mean there is less room for profit from simply flipping a company at a higher valuation. Recent analysis shows that many PE deals in the past few years were done at premiums that outpace market trends, leaving little slack.

2. Debt is more expensive. For much of the 2010s, rock-bottom interest rates fueled cheap leverage, but rates have since jumped to multi-decade highs. Servicing heavy debt loads now eats into profits, so portfolio companies must perform better operationally to meet return targets.

3.Holding periods have lengthened. It’s not uncommon for PE owners to hold companies 7-10 years now, versus 3-5 years in earlier eras. Over such longer horizons, sustainable growth and resilience become critical – you can’t just rely on a quick cost cut and resale. As PwC noted in 2024, “industry-leading PE firms are evolving beyond standard cost reduction and financial engineering” and getting more innovative about value creation levers that drive lasting impact.

In short, the PE playbook has expanded. Traditional levers like cost-cutting and leverage are still used, but they are no longer the star of the show – operational value creation is. A 2023 Bain & Company study found that 65% of private equity firms reported missing growth targets due to operational weaknesses rather than financial miscalculations. This underscores why modern PE firms are doubling down on operational due diligence and improvement. As one private equity blog (Blazej Kupec, June 2025) put it, financial engineering as the key value lever is “steadily giving way to operational improvements and EBITDA growth”. The new frontier of returns lies in building better companies through hands-on management.

Operational Turnarounds and Efficiency Improvements

One core aspect of operational value creation is the turnaround - helping an underperforming business run well. Top PE firms now arrive on day one of ownership with a detailed improvement plan. KKR, for example, pioneered the idea of the “100-Day Plan” to kick-start progress immediately. This approach lays out concrete steps to achieve strategic, financial, and operational goals in the first few months.

It addresses questions like: How will we improve profit margins? How can we shorten the supply chain? Which departments need more resources? Who is accountable for each initiative? By mapping these items line-by-line and business unit by business unit, the 100-day plan ensures everyone agrees on a roadmap for improvement and is held accountable from day one. Crucially, it focuses on forward-looking operating metrics – things like customer satisfaction, on-time delivery rates, and sales pipeline health – rather than just after-the-fact financials. Tracking these operational KPIs allows PE to spot brewing issues (say, a slip in service quality or a bottleneck in output) before they show up in the financial results, enabling faster corrective action. This proactive, metric-driven approach to operational turnaround has now been widely adopted across the PE industry.

Not all turnaround attempts succeed – if operational issues are overlooked, the results can be disastrous. For instance, TPG Capital’s investment in J. Crew failed in part because the firm underestimated operational cracks in J. Crew’s supply chain and merchandising. The company eventually went bankrupt (2020), a fate that might have been avoided with more rigorous operational due diligence and fixes upfront. The lesson is clear: ignoring operational fundamentals is a recipe for missed targets. That’s why leading firms like Blackstone, KKR, and Carlyle have built dedicated operational due diligence teams to scrutinize how a business really works (or doesn’t) before they invest. They examine everything from a target’s IT systems to its logistics and production processes, so they know exactly what to improve post-acquisition. By the time the deal closes, the new owners already have a playbook for value creation. Indeed, roughly 80% of large PE fund managers (with £10bn+ AUM) now engage in detailed value-creation planning at or before the point of investment – a striking change from a decade ago. In practice, this means day one of ownership often kicks off with a robust operational improvement program.

In a recent example of private equity value creation, Clayton, Dubilier & Rice (CD&R) acquired Morrisons in 2021 for £7 billion and undertook a significant operational turnaround. The firm reduced Morrisons’ debt by £2.4 billion through asset sales and refinancing, brought in new leadership with former Carrefour executive Rami Baitiéh, and implemented customer-focused initiatives such as involving shoppers in board discussions and daily performance reviews. Operational improvements across logistics, pricing, and store experience helped boost sales. During the 13 weeks to 27th April 2025, the group's total sales rose 4.2% to £3.9bn, with underlying EBITDA for the whole half-year period up 7.2% to £344m. This case exemplifies how strategic operational improvements and leadership changes under private equity ownership can revitalize a struggling UK retailer.

A recent survey completed by PWC in 2024 has shown that 69% of those surveyed anticipate the importance of value creation to rise in the future. This expectation reflects a growing consensus within the industry that operational excellence and strategic enhancements will be the keys to generating sustainable long-term returns.

Talent Upgrades as a Value Lever

For private equity firms, operational improvements start with people, so upgrading leadership is often the first lever of value creation. They rigorously evaluate management teams during due diligence and will swiftly replace or strengthen leadership if the incumbents lack the skills to execute an aggressive transformation plan. In fact, studies show it’s common for private equity owners to install a new CEO or other top executives within the first year or two after acquisition to drive change and meet ambitious targets. During ownership, firms closely monitor organisational health metrics like turnover and engagement, making talent changes or adjusting incentives if performance is at risk. Many also maintain networks of seasoned executives like ATP and have dedicated talent advisors to quickly fill leadership gaps or provide expert guidance to portfolio companies. Ultimately, even the best strategy will only succeed with the right team in place, making leadership quality a cornerstone of private equity value creation

Embracing Digital Transformation

Another major pillar of operational value creation today is Digital Transformation. Modern PE firms recognize that technology can dramatically improve a company’s performance - whether through analytics that uncover new insights, automation that cuts costs, or digital platforms that unlock new revenue streams. According to a 2022 KPMG survey, tech investments and digital transformation will double in importance over the next three years for private equity firms. Companies that are technologically advanced tend to command higher valuations (one KPMG study indicated that non-tech companies implementing digital initiatives trade at up to a 23% premium over those that don’t). Accordingly, PE firms are aggressively pushing their portfolio companies to modernize and digitise operations.

Digital transformation in PE portfolios takes many forms. Sometimes it’s about data and analytics - using advanced analysis to refine pricing or using predictive models to manage inventory more efficiently. Other times it’s about process automation - implementing software to automate routine tasks, thereby reducing costs or error rates. Increasingly, it also includes adopting cutting-edge technologies like AI. Some leading PE firms have started deploying AI tools across their portfolios integrating AI into core operations, using automation in due diligence and AI-driven analysis to identify efficiency opportunities. Thoma Bravo, a tech-focused PE firm, used natural language processing to rapidly analyse tens of thousands of customer contracts during due diligence in 2025, uncovering revenue opportunities that boosted customer retention by 15% in a year – a clear example of digital tools creating value.

Large PE houses are even building in-house tech teams and networks to drive these initiatives. For example, Carlyle Group has assembled a network of technical specialists who can be deployed across portfolio companies for targeted transformation projects. These might be experts in cloud computing, cybersecurity, data science, etc., who parachute in to lead critical upgrades or to develop a digital strategy for a portfolio business. Other firms have created centres of excellence to share digital best practices. The emphasis is on making sure each portfolio company can harness modern technology to improve its competitive position – whether that means launching an e-commerce channel, upgrading to a unified ERP system, or using IoT sensors to optimize a factory. Notably, digital initiatives often go hand-in-hand with longer investment horizons. PE firms pursuing technology-driven transformations may opt for longer hold periods to allow multiple waves of tech upgrades and to realise compounding benefits. Blackstone, has a “Core” fund with 8 to 20-year horizons for exactly this reason.

In summary, digital transformation has become a key lever for value creation. It’s not just about cutting IT costs; it’s about using technology to reinvent business models and unlock growth. PE owners encourage portfolio CEOs to think like tech CEOs – to centre strategy around digital capabilities. A 2022 Moonfare industry report noted that digitally more advanced companies are easier to scale, integrate and “likely attract a higher premium once sold”.

Tracking Performance with the Right Metrics - what gets measured gets done

Underlying all these efforts is an emphasis on measurement and accountability. Unlike passive investors, PE firms take an active, hands-on approach and they want to see tangible results. To ensure operational initiatives are delivering, firms establish a robust system of performance metrics for each portfolio company. These go beyond traditional financials to include operational and strategic KPIs that align with the value creation plan. This sharp focus on metrics and accountability creates a culture of execution. One could say that in a PE-owned company, what gets measured gets done.

Conclusion: Sustainable Returns are Built on Operational Success

For today’s business leaders, the rise of operational value creation in private equity carries an important message. PE firms today position themselves not just as financiers, but as partners in building better businesses. The old image of PE owners simply piling on debt and slashing budgets to make a quick profit is becoming outdated. In its place, a new strategy has emerged – one where hands-on operational improvement, talent management, digital innovation, and rigorous performance tracking are the drivers of returns.

Private equity’s intense focus on operational value creation is reshaping the companies they invest in, often for the better. Portfolio companies frequently come out the other side of PE ownership as more competitive, growth-oriented enterprises. We see PE owners acting as catalysts for change – bringing in new leadership, injecting fresh ideas (like lean processes or AI tools), and instilling a performance culture tuned to key metrics. Of course, the motive is to achieve high returns at exit, but the byproduct is often a sturdier, more profitable company. As one 2025 analysis report put it, the sector’s priorities have shifted “away from aggressive growth maximisation towards sustainable, realistic value creation through operational improvements” (Alvarez & Marsal).

In conclusion, operational value creation is now taking centre stage for private equity returns. Firms like KKR, Carlyle, Bain Capital, and others are proving that the path to superior investment performance lies in rolling up their sleeves and improving the companies they own. For investors and business leaders alike, the takeaway is clear: sustainable returns are built on operational success. Private equity’s renewed focus on operations is not just a trend but a fundamental shift – one that is likely to define the industry’s best practices in the years ahead, and in the process, elevate the businesses under their ownership to new heights of performance.

Sources: available on request